paying indiana state taxes late

The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal. Web DOR offers customers several payment options including payment plans for liabilities over 100.

Web April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe.

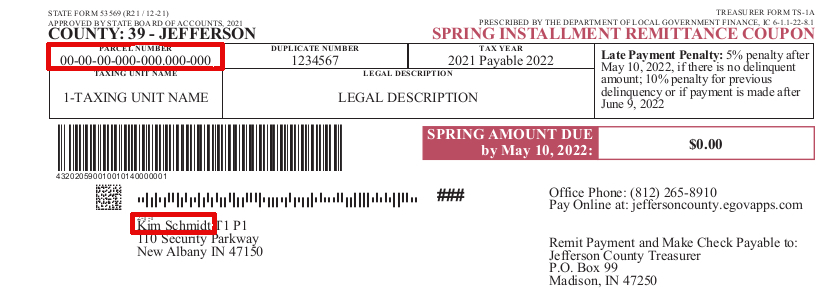

. If your payment is returned for any reason there will be a 2500 NSF fee per county ordinance. You may request a filing extension but this does not push back the payment due date. Pay online quickly and easily using your checking.

This penalty is also. By law the IRS may assess penalties to taxpayers for. 30 thanks to the 1992 Taxpayers Bill of Rights TABOR.

Solve Your IRS Debt Problems. INDIANAPOLIS Hoosiers expecting a little extra in their tax refund will have to wait before cashing in. DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022.

Solve Your IRS Debt Problems. This penalty is also. Ad As Seen On TV Radio.

These conditions apply to all payments. Web Tax Payments in General. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Ad Use our tax forgiveness calculator to estimate potential relief available. Web The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan. Individual Income Tax Payment Plans.

Ad BBB Accredited A Rating. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. This year almost all.

Web What is the penalty for paying Indiana state taxes late. Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Indiana Department of Revenue.

Web According to the Indiana Department of Insurance sellers can expect to pay 335 of their homes final sale price when closing on a home. Web An official website of the Indiana State Government. Web Including local taxes the indiana use tax can be as high as 0000.

Here are your payment options. BBB Accredited A Ratings. End Your IRS Tax Problems -.

Web State residents who have filed their 2021 return by June 30 will get a physical check for 750 by Sept. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Web What happens if you pay Indiana state taxes late.

List of Companies Trusted by 1000s. Web What is the penalty for paying Indiana state taxes late. A home worth 221977 in.

Ad As Seen On TV Radio. Ad Let Us Find You The Best Tax Relief Company In Your Area Get Help With Back Taxes. Apr 13 2022 1014 AM EDT.

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Do I Have To File State Taxes H R Block

Late Filing And Late Payment Penalties Ils

Late Filing And Late Payment Penalties Ils

Irs To Refund Penalties For Millions Of Taxpayers Who Filed Late Amid Pandemic

Tax Deadline Extension What Is And Isn T Extended Smartasset

Indiana State Tax Information Support

Irs Form 4868 How To Get A Tax Extension In 2022 Marca

Irs Late Filing Will The Irs Accept A Late Return If I Missed The Deadline Marca

Irs Tax Refunds Coming If You Paid Late Tax Filing Penalties Money

Dor What Happens If I Don T Pay My Indiana Income Taxes

Tax Penalties Here S What To Do If You Can T Pay Your Taxes This Year Abc7 Chicago

/cloudfront-us-east-1.images.arcpublishing.com/gray/MM77HGSL3FFE5GT4HHPKHD3P6I.jpg)

Irs To Refund Penalties For Millions Of Taxpayers Who Filed Late Amid Pandemic

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2